World Football Summit looks at the eSports market in China and how football clubs are stepping into the space. This article features as part of the latest edition of WFS Digest, our new insider’s guide to the latest and most relevant thoughts and practises from within the football industry. You can subscribe to WFS Digest HERE.

By the beginning of 2022, most European football clubs had already diversified their online strategies towards gaming and esports, with the objective of increasing engagement among younger fans and crafting a new, sustainable revenue stream for the years ahead.

«Looking to capitalise on an increasingly valuable Chinese esports market is certainly no easy task, especially when dealing with post-Covid falling revenues and ticket sales.»

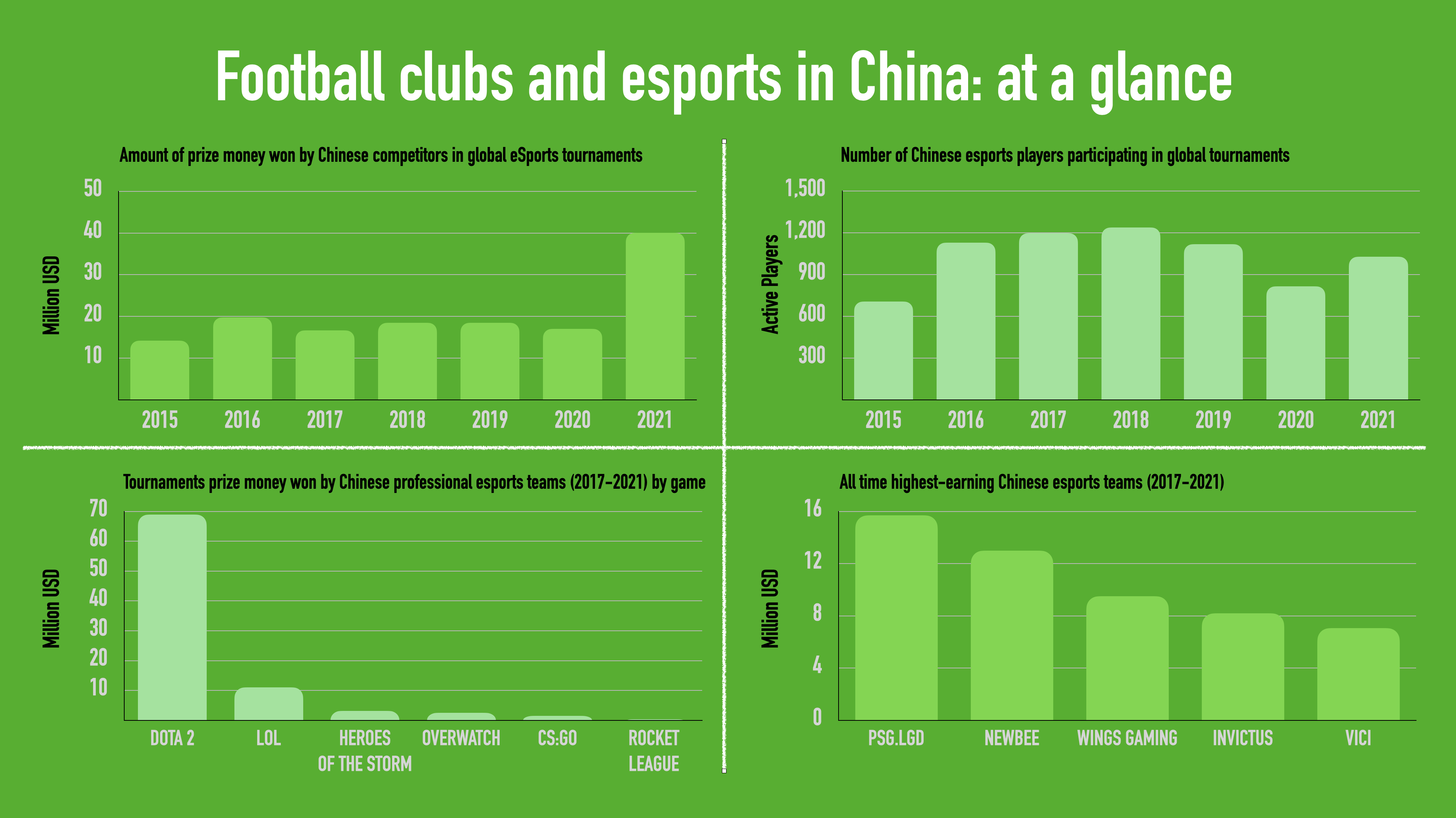

In China, eSports is rapidly gaining popularity and scope. In 2021, the market revenue of esports gaming in the country grew to 22 billion USD, up 2.65 percent from 2020. In the same year, data from the Game Committee of the Publishers Association of China showed that the number of eSports game users in the country increased by around 0.27 percent to some 405 million users, 38.6 percent of whom were under 22 years of age, evenly distributed between blockbuster franchises like League of Legends, Fortnite, DOTA 2, and FIFA Online.

But what ultimately attracts marketing executives of elite football clubs is the average daily browsing time spent per content by members of their fanbase. Repeated turnover of users means higher engagement rates per post, higher views, and consequently lower costs per view for club’s sponsors.

In China, the daily consumption of eSports content as of March 2021 amounted to a staggering two minutes and 52 seconds, encouraging even more brands to invest in the eSports industry. Indeed, between 2019 and 2020 brand sponsorships accounted for about a third of the total esports tournament revenue in the country.

Leading from the front

Leading from the front

In China, behemoth football clubs like Manchester City and Paris Saint-Germain are fine-tuning their eSports strategies while consolidating their local social media presence.

In 2018, Manchester City became the first Premier League club to launch a FIFA Online team in China. And instead of just unveiling a team of five pro eSports players, the club strategically announced at an exclusive launch alongside representatives from Tencent and the Association for Chinese Esports that the remaining two spots on the roster would be filled by local supporters, who would earn their places by taking part in a nationwide competition.

This operation not only helped the club ramp up numbers on official social media accounts (a precondition to entering the competition) but also made the dream of joining the esports team achievable for all fans, something that is impossible to replicate in actual football.

Moreover, cementing the relationship with Tencent, which has a market value of 461 billion USD, was always part of the strategy. Tencent is the leading video games publisher and distributor in mainland China, with a reported total revenue of 24 billion USD from online games in 2020.

Manchester City Football Club’s chief marketing officer Nuria Tarre told The Drum: “China is a very big market for us. It’s a huge growth market for football with almost 60% of the population interested in football. Our research shows one of the key ways to engage young fans is through esports and that’s how we get to connect with our core audience of under-35-year-olds.”

When bearing in mind fans’ inability to physically engage with the club by traveling to games, creating emotional engagement to eventually trigger their spending power has to be creatively delivered by other means. Social media presence and esports are two such means identified by the club.

Paris Saint-Germain has also strategically expanded its esports division since 2018, although not by directly establishing a local entity but instead through a partnership with Chinese esports organisation LGD Gaming. The two organisations initially co-branded a DOTA 2 team, one of the games with the highest prize pools in the world, standing at a little more than 47 million USD at the end of 2021.

Later in 2018, PSG also formed a FIFA Online team as part of its mission to build a brand presence in mainland China, in the process becoming the first elite European club to invest in both the DOTA 2 and FIFA Online scenes in the country.

The performance outcome has been incredibly positive. In 2018, the PSG LGD team won their first international championship, before adding a second weeks later. The following season saw a third place finish at The International in Shanghai and victory in the China DOTA 2 Professional League, with an estimated total prize-pool revenue to date of 15 million USD.

Needless to say, this competitive vision has been corroborated by the signing of multiple commercial partnerships in China along the way, most notably with Hisense and GeekVape.

Risky investment or Opportunity Cost?

More brands are riding the hype train to reach younger segments of their fandom by sponsoring esports tournaments and clubs, although a consumer survey found that Chinese eSports fans were not entirely on board with regards to their favourite esports clubs gaining brand sponsorships. As per results in 2020, about 42% of respondents considered sponsorships good for the operation of eSports clubs, whereas around 35 percent expressed serious concerns in this area – mostly in relation to the competitive nature of the roster against content creation and media value interests.

Competitive video gaming is the main driver in China: approximately 51.7% of Chinese esports fans surveyed said they watched eSports tournaments to improve their gaming skills, more than any other option included on the questionnaire.

What should football clubs do, then, to successfully engage their younger Chinese audience and achieve financial sustainability?

In short, they need to assemble a winning eSports team in a major video games franchise.

In reality, they must also partner with relevant stakeholders in the market, such as publishers, distributors, or streaming platforms, before activating brand sponsorships.

In the successful case of Manchester City, the launch of their eSports team in China was shortly followed by the partnership announcement with Tencent Esports to establish the Tencent Esports Tech-Union.

The aim of that deal is to craft a new form of entertainment by combining esports and traditional football, creating a cultural cross-over to funnel the interest and spending power of Chinese Generation Z and Alpha into the club’s merchandising, e-commerce and in-game downloadable content (for example, the Cityzens Fortnite skins).

While their previous agreement focused mainly on the football side, including the squad’s tour of China in 2016, two years later the situation had evolved somewhat, with a deal delivering Manchester City club-themed digital assets to Honor of Kings, Tencent’s star product within its gaming division.

In conclusion, looking to capitalise on an increasingly valuable Chinese esports market is certainly no easy task, especially when dealing with post-Covid falling revenues and ticket sales. Diversifying revenue streams is the paramount objective, in the form of eSports prize pools, roster sponsorship deals, or in-game micro-transactions for digital club collectibles; in short, turning fandom into revenue.

In an age of mounting need to future-proof fanbases when considering the impending demographic cliff facing matchday attendances and broadcasters, looking at overseas markets and esports would certainly appear to be part of the solution.

This article features as part of the latest edition of WFS Digest, our new insider’s guide to the latest and most relevant thoughts and practises from within the football industry. You can subscribe to WFS Digest HERE.

©Ganassa LLC, Tokyo, 2022