At World Football Summit Riyadh, the full scope of Saudi Arabia’s football transformation came into focus—not through marketing statements, but through data shared by the institutions driving it.

Representatives from the Ministry of Sport, the Ministry of Investment (MISA), the Saudi Pro League, the Saudi Arabian Football Federation and several of the country’s biggest professional clubs presented concrete figures on league growth, talent development, women’s football infrastructure, international event hosting, and population-level sports participation.

The picture that emerged shows an ecosystem developing rapidly across every dimension—from commercial revenue and foreign investment to youth academies and mass engagement. These are the numbers behind the transformation.

The Saudi Pro League: Commercial and Competitive Growth

The Saudi Pro League’s revenue has tripled over the past three years. A recent long-term broadcasting deal delivered a 50% increase in value, the league now broadcasts in over 180 countries, and its social media presence has grown tenfold, according to Omar Mugharbel, CEO of the Saudi Pro League.

Part of this growth stems from structural changes in club ownership. Eleven clubs have been privatized, with more in the pipeline—a shift designed to bring operational expertise alongside capital.

“Privatization is not an objective in itself,” explained Ibrahim Almoaiqel, Assistant Deputy Minister for Investment & Privatization of the Ministry of Sport. “Our objective is to partner with people who have the know-how to operate clubs sustainably for better football and commercial outcomes.”

The ambition driving this transformation is clear.

“We are trying to keep our league within the Top 5 worldwide,” said Basim Ibrahim Sport Sector Investment Director at MISA.

Ben Harburg, whose Harburg Group recently acquired Al Kholood through the privatization process, went even further:

“This is not a backwater league. This should take its place as one of the most powerful leagues in the world.”

The strategy has attracted foreign talent at scale. More than 235 foreign players have joined Saudi clubs, according to Ibrahim. But Mugharbel was clear about the balance required:

“In order to be competitive with Serie A or La Liga, we also need to keep control, good governance, solid pillars to be sure the acceleration is controlled and in a good direction.”

From Star Signings to Talent Development

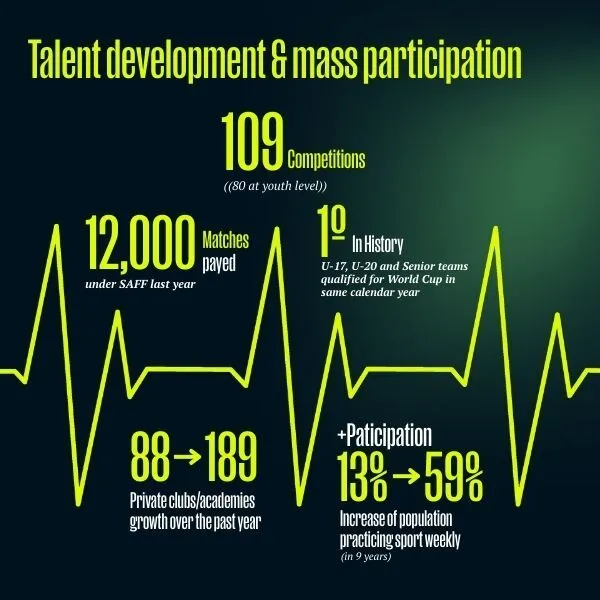

Beyond high-profile signings, the focus now extends to building the infrastructure for homegrown talent. The Saudi Arabian Football Federation oversaw 12,000 matches last year across 109 competitions, 80 of them at youth level. Supporting this expansion, the number of private clubs and academies jumped from 88 to 189 in a single year. SAFF now tracks player development across 60-70 parameters through a unified platform covering the entire pathway from youth academies to the national team, according to Hicham El Amrani Senior Advisor to SAFF.

The investment is already producing competitive results.

“For the first time in our history, in the same calendar year, the under-17, under-20, and senior national teams qualified for the World Cup,” said Lamia Bahaian, Vice President of SAFF. “This reflects real alignment in our pathways, our communities, and shows our long-term investments are bringing results.”

Women’s Football: Structure and Momentum

Within this broader growth, women’s football stands out for the pace of its development.

“Women’s football in Saudi Arabia is building real momentum, structure, opportunity, and belief,” said Bahaian.

The women’s premier league now features players from over 20 nationalities, all of whom represent their national teams, according to Bahaian.

The change is visible in club operations. Eastern Flames FC now runs six teams—first team, U-17, U-15, U-13, U-11, and futsal—creating pathways that didn’t exist two years ago. The club secured Puma as an international brand partner, demonstrating commercial viability alongside competitive development.

Maram Al Butairi from Eastern Flames described the pace:

“Two years ago it was very challenging for women’s football in KSA. Now, many people are interested in acquiring our club and partnering with us. Comparing ourselves with the rest of the world, we are going at rocket speed to develop women’s teams at youth and grassroots levels.”

Beyond Professional Sport: Population-Level Participation

But the most significant shift may be in mass participation rather than elite competition. Nine years ago, 13% of Saudi Arabia’s population practiced sport. Today, that figure stands at 59% practicing sport weekly—a fourfold increase, according to Almoaiqel from the Ministry of Sport.

The change reflects infrastructure access that didn’t exist a decade ago.

“Nine years ago in KSA, if you wanted to attend a major event, you had to travel abroad,” Almoaiqel said. “Today, the Saudi people are overflowing with options.”

Football sits at the center of this participation growth. Over 60% of Saudi citizens now consider themselves devoted football fans, according to Jesus Arroyo from the Saudi Pro League. The infrastructure development—from elite competition to grassroots facilities—has created access at every level.

The figures presented by Saudi officials at World Football Summit Riyadh show an ecosystem they describe as developing across every level—professional league revenue, youth development structures, women’s football pathways, international event hosting, and mass participation. Whether these initiatives translate into sustained competitive success will depend on maintaining investment, developing homegrown talent, and building the institutional capabilities to support long-term growth.